Our investment approach is rooted in the US Endowment Model as codified by the late David Swensen (CIO of Yale University’s endowment), in his seminal book published in 2001 – “Pioneering Portfolio Management”. The “Yale Model” as it is called is underpinned by three key principles:

- Risk: Keeping a high level of overall portfolio risk and avoiding market timing

- Asset Allocation: Pursuing multi-asset class diversification, with a significant allocation to alternative asset classes

- Manager Selection: Populating each asset class with high-quality investment managers who are chosen for their ability to outperform

Over the last two decades, capital markets have evolved significantly. The alternative asset management industry has seen massive capital inflows and has now become “mainstream”. At the same time, the passive management industry has exploded with trillions of dollars invested today by retail and institutional investors. These seismic shifts have challenged the classic Yale Model as outperforming a passive mix of low-cost instruments in orders of magnitude harder today than it was twenty years ago.

In response, we have evolved the Yale Model over the last 20 years into what we term the

Partners Capital Risk Managed Endowment Approach or “PRMEA”. The most important developments are:

Risk

Defining true risk as “aggregated market exposure” rather than “volatility” that is backward looking. We use our proprietary “Equivalent Net Equity Beta or ENEB” approach that allows us to quantify risk on a look-through basis in any client portfolio.

Asset Allocation

Avoiding reliance on asset class labels to diversify and instead focusing on the underlying market exposures (or “betas”) to ensure proper diversification. This requires the ability to look-through and understand a manager’s exposures.

Manager Selection

Selecting managers on their perceived ability to outperform equivalent risk low cost passive instruments, and pursing a wide array of structured manager partnerships (including separately-managed accounts and co-investments) to provide optimal return on fees paid.

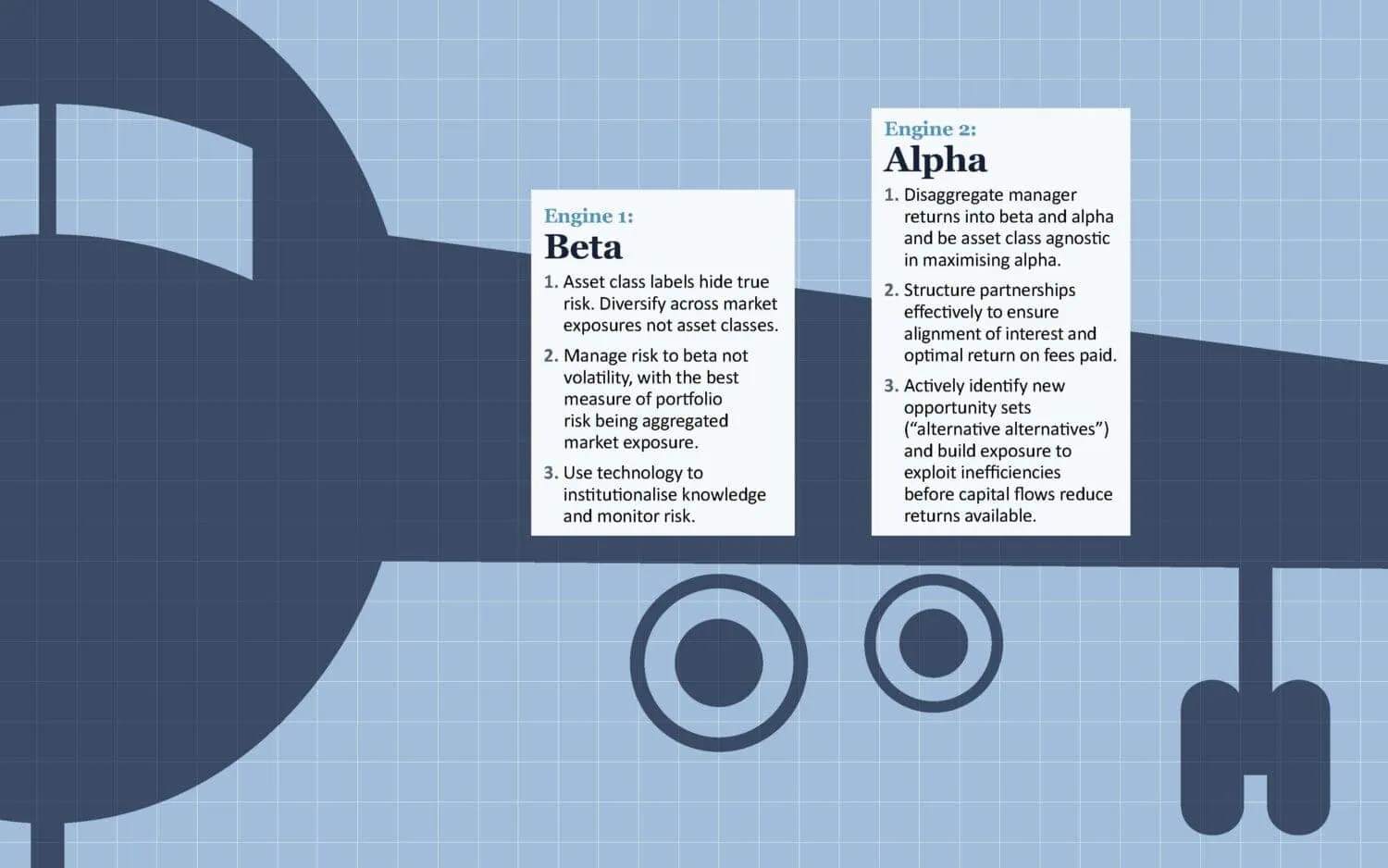

Twin Engine Approach

We think of this PRMEA approach as best visualised as a “twin-engine plane” with two distinct performance drivers in any portfolio.

Engine 1 is the “Beta” engine that delivers the base return of the portfolio, while Engine 2 is the “Alpha” engine that delivers the turbocharge or outperformance.

Contact us for more information on the Partners Capital Risk Managed Endowment Approach (PRMEA).

Sustainable Investing

Partners Capital aim to educate and assist clients in the implementation of sustainable investment strategies whilst achieving long term investment performance at the top of their peer group.

Read our Partners Capital Sustainability Charter, which sets out our six core beliefs.