Our History

Founded in 2001, Partners Capital is an Outsourced Investment Office acting for distinguished endowments and foundations, senior investment professionals and prominent families across the globe. With $50B+ in assets under management, the firm constructs customised investment portfolios for its clients tapping into its deep network of partnerships with what we consider exceptional asset managers across all major asset classes. The firm employs more than 350 people across its seven offices located in Boston, New York, London, San Francisco, Paris, Singapore and Hong Kong.

Our mission is to deliver sustainable long-term outperformance to our clients by bringing an evolved institutional investment approach to building and managing portfolios – called the Partners Capital Risk Management Endowment Approach (PRMEA).

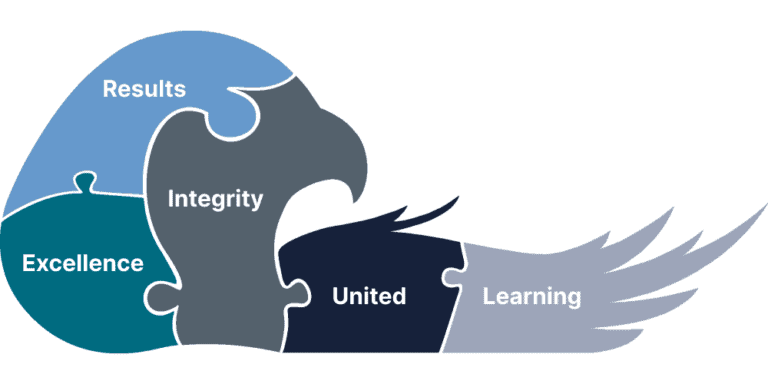

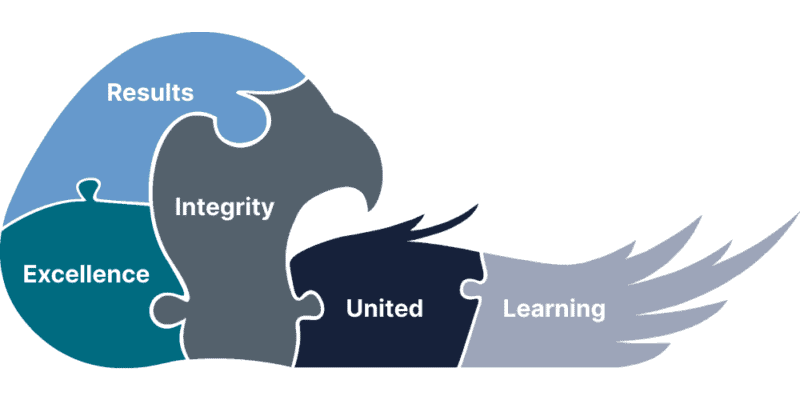

Our Core Values

Who We Work With

Since our founding in 2001, Partners Capital has been fortunate to be able to serve some of the world’s leading investors. Our initial client base consisted of founders and senior partners of the world’s leading private equity firms who were seeking a service that was totally independent and conflict-free, unlike much of the peer group then. This led us to be considered as the “money manager to the money managers”.

Today our client base has extended to include prestigious endowments, foundations, and sophisticated family offices across the globe. For all clients we aim to deliver superior and sustainable long-term returns by creating tailored portfolios depending on their risk profile, time horizon, liquidity constraints, tax domicile and investment objectives.

For most of our clients, we manage a fully diversified multi-asset class portfolio that encompasses the majority of their balance sheet. However, we also partner with larger family offices and institutions such as pensions and sovereign wealth funds to offer highly specialised mandates that may include certain asset classes (e.g., private market assets) or thematic portfolios (e.g., Impact or Asia oriented).